First time in my lifetime: a current account surplus

June 1975. Australia records a current account surplus.

September 2019. Australia records its next current account surplus.

This is an interesting development for the Australian economy. But, before we look at why this matters, let’s discuss what this all means.

Current account: the economic theory

Australia’s current account is part of the Balance of Payments (BoP). The BoP records transactions between Australia and the rest of the world. It’s a major measure of the nation’s external stability — Australia’s ability to successfully meet its foreign liabilities.

The BoP consists of the current account and the capital and financial account (KAFA). We’re just focussing on the current account here.

The current account shows inflows and outflows into Australia for trade in goods and services, income flows and other elements (such as transfer payments). Transactions on the current account are non-reversible.

Australia’s long history of current account deficits (CADs)

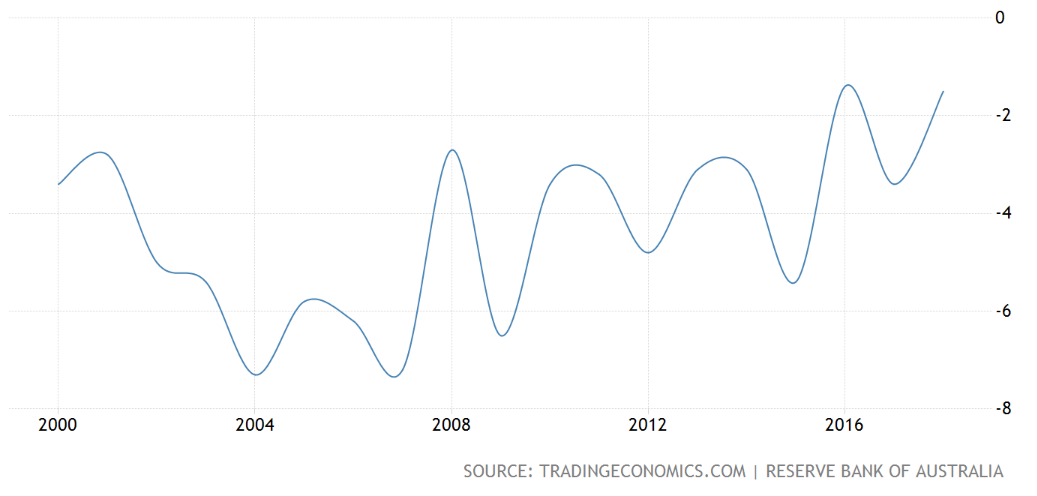

Between 1975 and 2019, Australia has recorded persistent CADs. This means outflows exceed inflows on the current account. In the graph below you can see the size of the CAD (as a percentage of GDP) between 2000 and 2019 in Australia.

The main causes (or main drivers) of a CAD involve the Balance on Goods and Services (net exports, or BoGS) and Net Primary Income (NPY). BoGS involves payments receipts for exports and imports of goods and services. NPY involves income flows, in and out of Australia, including dividends, rent and interest.

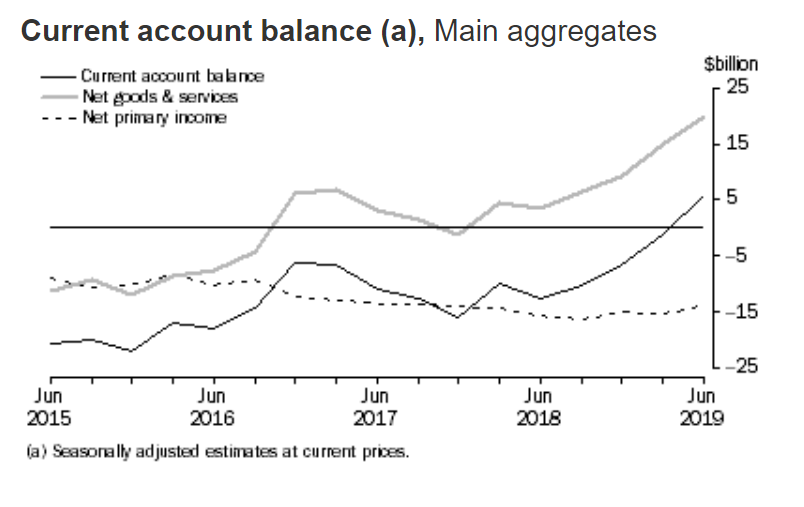

If you look at the graph below from the Australian Bureau of Statistics (ABS) you can see that NPY is usually in deficit. (We’ll go through why in another post.) But BoGS (net goods in the graph below) can fluctuate substantially and swing from deficit to surplus.

As of September 2019, BoGS is in surplus to the tune of $20 billion — the largest surplus recorded in Australia’s history. As a result, in September, the current account is now in surplus (a small surplus, $5 billion, but still a surplus).

Why does Australia (currently) have a current account surplus?

The current account surplus is due to the BoGS surplus. But don’t take my word for it. Here’s what ABS Chief Economist Bruce Hockman said.

"Six consecutive quarters of goods and services surpluses, broadly commodity driven, have laid the foundation for our first current account surplus in 44 years,” he said.

Mr Hockman added the export prices AND volumes had risen...while import volumes fell during the same period (potentially due to the depreciating Australian dollar making imports more expensive).

"Export volumes for the key bulk commodities of liquid natural gas, coal and iron ore were up, while volumes fell across several import categories resulting in an increased June quarter trade surplus," he said.

We’ll just have to wait and see if the current remains in surplus or whether this was a temporary event.

GOOD TO KNOW

BoGs is also known as the trade balance. So a BoGS surplus is also known as a trade surplus.